CONFLICT OF INTEREST POLICY

1.0 INTRODUCTION

|

Timberwell Berhad (“the Company”) and its subsidiaries (“collectively referred to as “TWB Group”) is committed to maintaining the highest of ethical standards and recognises that it must be always seen to be acting in accordance with highest standards of governance. Accordingly, TWB Group expects all staff to conduct themselves with integrity, impartiality and professionalism at all times, and to avoid any conflict of interest that may arise in the performance of their duties. Proper identification and management of conflicts of interest ensures that business decisions are made in the best interests of the Company and the Company is protected from any consequent damage to its activities and reputation. |

2.0 PURPOSE

|

The purpose of this Conflict of Interest Policy (“Policy”) is to ensure that actual, potential and perceived conflicts of interest are identified and managed effectively. It is intended to provide guidance on how to identify and declare all conflicts of interest, how to develop, implement and monitor actions to appropriately manage the conflict, and how to deal with breaches of this Policy. |

3.0 SCOPE

|

This Policy applies to all Directors and Key Senior Management of TWB Group. It outlines the framework and the processes for the purposes of preventing any conflicts from influencing or compromising the objectivity and impartiality of the business operations, as well as to safeguard the reputation and credibility of the Company. It also serves as a guide to the Audit Committee (“AC”) and Board of Directors (“Board”) of the Company in discharging their role, which is to provide oversight and review the conflict of interest situations that arose, persist or may arise within the Group. The Key Senior Management refers to Managing Director and/or Chief Executive Officer who is not a Director, Chief Operation Officer, Chief Financial Officer and/or any other person primarily responsible for the management of the subsidiaries. This Policy applies whenever the Directors and Key Senior Management recognises, or should reasonably recognise, that a conflict of interest may arise from their current or future activities. The scope of this Policy is relatively wide in its coverage of activities that may give rise to conflicts of interest. As it is not possible for the Policy to be all-inclusive, Directors and Key Senior Management are expected to exercise reasonable judgement, adhering to the intent of the Policy. |

4.0 DEFINITIONS

|

“Beneficial interest” refers to the right to receive economic benefits from an asset without being the legal owner of the asset, e.g. entitlement of income from shares held through a nominee. “Conflict of interest” is a situation in which a person has competing interests and the serving of one interest could improperly influence (direct or indirectly) the performance of duties and responsibilities, and which may be at the detriment and/or personal to another. Conflict of interest includes actual, potential, or perceived conflict of interest. “Family member” , in relation to a person, means:

“Material Shareholdings” in relation to shareholding means equity ownership of 5% or more. “Person Connected” means person connected as defined in Chapter 1.01 of Main Market Listing Requirements of Bursa Malaysia Securities Berhad. |

5.0 IDENTIFICATION OF CONFLICTS OF INTEREST CIRCUMSTANCES AND SITUATIONS

|

A Conflict of Interest would arise where a person’s ability to perform his / her duties effectively and impartially is potentially impaired by personal interests, considerations or relationships. Generally, conflicts of interest may be described under the following broad categories, but the list is not exhaustive:

This is where a Director or Key Senior Management holds shares in privately owned entities having a business relationship with TWB Group, either directly or indirectly (e.g. through a Family member). This does not apply to shares held in publicly quoted companies which have a business relationship with TWB Group, unless such holding is considered to be material and the interest is likely to impair the objectivity of the Director or Key Senior Management concerned. This applies to situations where the Director or Key Senior Management holds a position or has interest in entities having a business relationship with TWB Group which may lead to disclosure of confidential information obtained by reason of being a Director or Key Senior Management of one company to another company of which he/she is also a Director or Key Senior Management, including financial interest in any of TWB Group projects, contracts, sales, transactions or other business dealing or have family members or Associates with such interest. A conflict of interest or potential conflict of interest would exist if a Family member of the Director or Key Senior Management has a reporting relationship with the Director or Key Senior Management. A conflict of interest would also arise if a Director or Key Senior Management has a Family member with an interest (e.g. in the form of ownership, directorships, partnerships, employment, etc.) in entities which have a contractual arrangement with TWB Group. This refers to situations where TWB Group purchases or leases property, equipment, materials, etc. from Directors or Key Senior Management, or enters into contractual arrangements with Directors or Key Senior Management (other than employment contracts). Such situations give rise to a conflict of interest, and should be declared. If a Director, Key Senior Management or Family member of a Director or Key Senior Management has financial or other interests or any involvement in the business of a competitor, or holds a directorship in a competitor, such a situation would give rise to a conflict of interest. This does not apply to the holding of publicly quoted shares of competitor companies, unless such holding is considered to be material and the interest is likely to impair the objectivity of the Director or Key Senior Management concerned. If a Director or Key Senior Management has accepted employment with a competitor, this could also result in a conflict of interest during the period which he/she is still employed with TWB Group, especially if the Director or Key Senior Management is dealing with sensitive or confidential information. As such, the conflict of interest must be declared immediately upon acceptance of employment with the competitor to enable TWB Group to take the necessary actions to manage the conflict. A conflict of interest arises if a Director or Key Senior Management participates in activities where he/she is the subject of the discussion or where the decision involves him/her. |

6.0 GENERAL RESPONSIBILITIES

|

All Directors and Key Senior Management of TWB Group are responsible for identifying and managing conflicts of interest on an ongoing basis and are required to:

|

7.0 MANAGING CONFLICT OF INTEREST

|

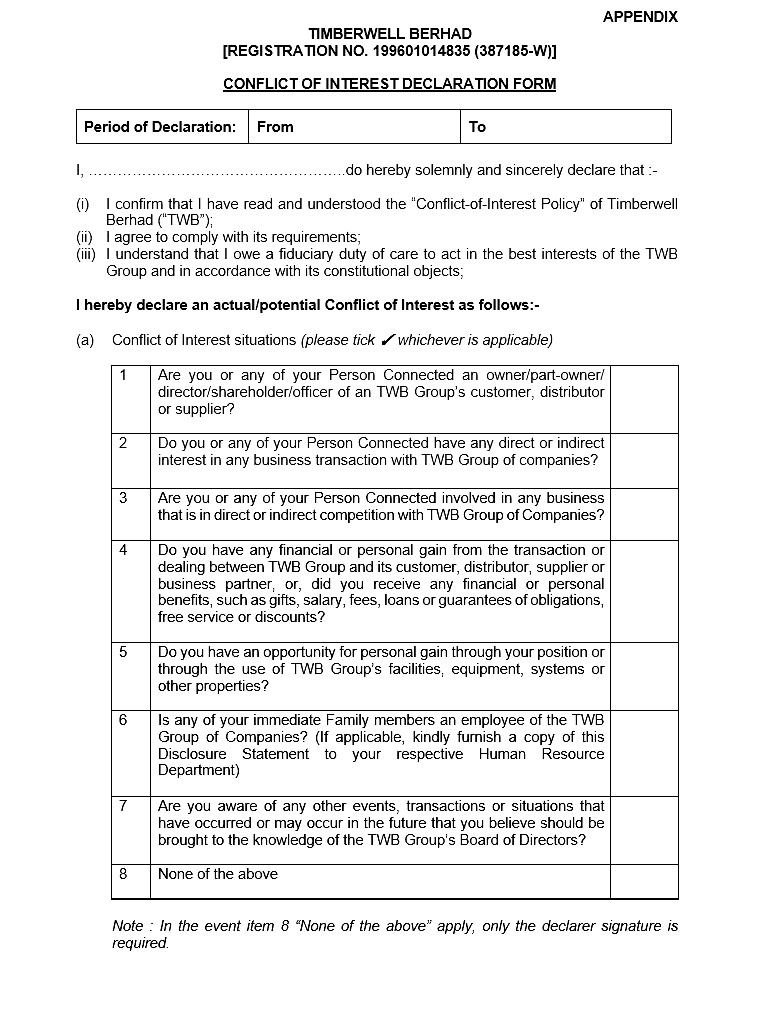

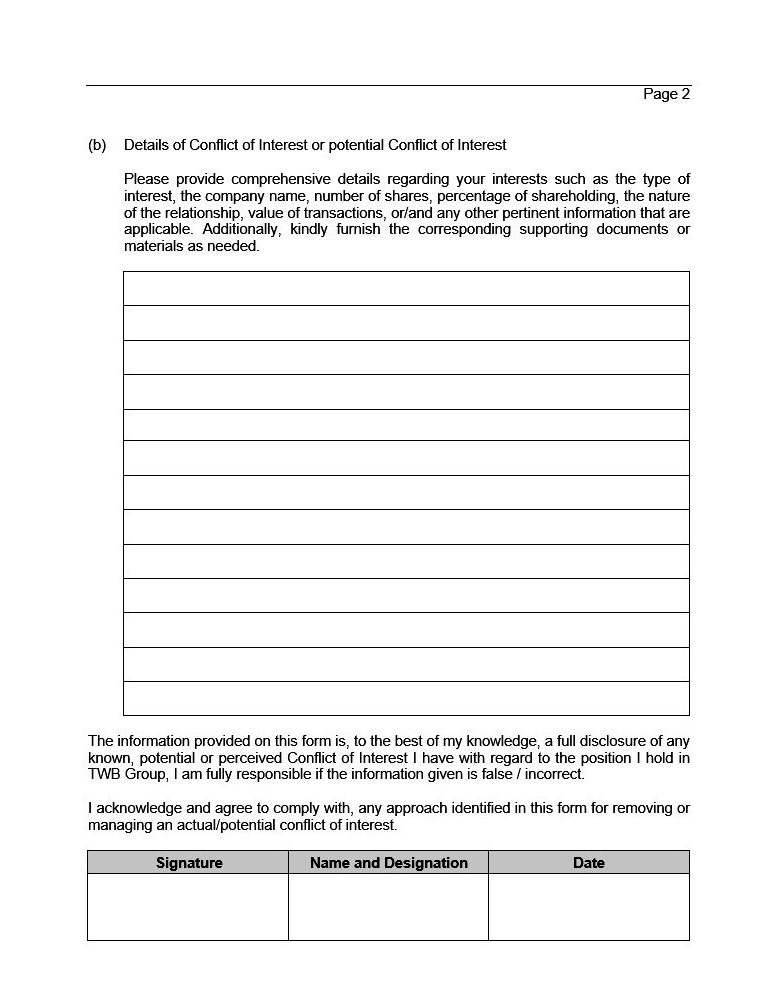

7.1 It is the duty of the Directors and Key Senior Management’s fiduciary duty to avoid conflict of interest and comply with the relevant guidelines in respect of their fiduciary duties. 7.2. A Director or Key Senior Management, who having an interest either directly or indirectly or whether actual or potential, in any transaction or arrangement with TWB Group, or holding any office or possessing any property where duties or interests as Director may be created in conflict with his duties or interests as Director of TWB Group shall as soon as practicable after the facts have come to the Director’s knowledge, or, after becoming director or possessing the property (as the case may be), declare the nature, character and extent of the Director’s interest and conflict to the AC via the “Conflict of Interest Declaration Form” as set out in Appendix of this Policy. 7.3 The AC shall review the declaration make by the Director or Key Senior Management and propose the course of action to take to manage the conflict as well as to mitigate the impact of the conflict on the decision making process. 7.4 When a determination has been made that there is a conflict of interest arose, persist or may arise, the AC must report and make recommendations to the Board to direct the conflicted party(ies) to, but not limited to the following:

7.5 The Company Secretary shall record in the minutes the details of the conflict of interest that has arisen, the declaration by the Conflicted Directors and the fact that the Conflicted Director was requested to leave the Board Meeting for discussion of the matter of issue. In cases, where the declaration is made outside of meeting times, the disclosure will be documented in the minutes of the subsequent meeting. 7.6 The annual declaration form of conflict of interest by Director and Key Senior Management will be maintained by the Company Secretary. |

8.0 DISCLOSURE AND DECLARATION

|

8.1 All Directors and Key Senior Management are/is required to make declaration of conflict of interest annually via the “Conflict of Interest Declaration Form” attached in this Policy. 8.2 The Declaration Form must be disclosed to the AC for deliberation and approval, before submitting to the Board for final endorsement and recorded by the Company Secretary in the minutes of meetings. 8.3 Where there is any change in the nature and extent of the Director’s or Key Senior Management’s interest subsequent to the disclosure, the Director or Key Senior Management shall make a further disclosure of such changes. |

9.0 DISCLOSURE AND DECLARATION

|

This Policy shall not apply to an arrangement or transaction by an entity within TWB Group (i) and any of its wholly-owned subsidiaries; (ii) and its holding company which holds all the issued shares of the entity within TWB Group; or (iii) which is a wholly-owned subsidiary of a holding company and another wholly-owned subsidiary company of that same holding company. |

10.0 BREACH OF POLICY

|

Directors and Key Senior Management are obligated to adhere to all COI requirements as stipulated in this Policy along with any requirements set forth by the MMLR of Bursa Securities or other relevant regulatory guidelines. Any breach or non-compliance with this Policy will be subject to appropriate internal disciplinary action and applicable civil and criminal liability. |

11.0 REVIEW OF THE POLICY

|

This Policy will be subject to review and revision from time to time as and when the need arises but in any event at least once every three (3) years. Such revision shall be effective after the same is circulated to all in writing or electronically. This Policy has been adopted by the Board of Directors and shall come into force with effect from 21 February 2024. |