|

1.1 Board Committees

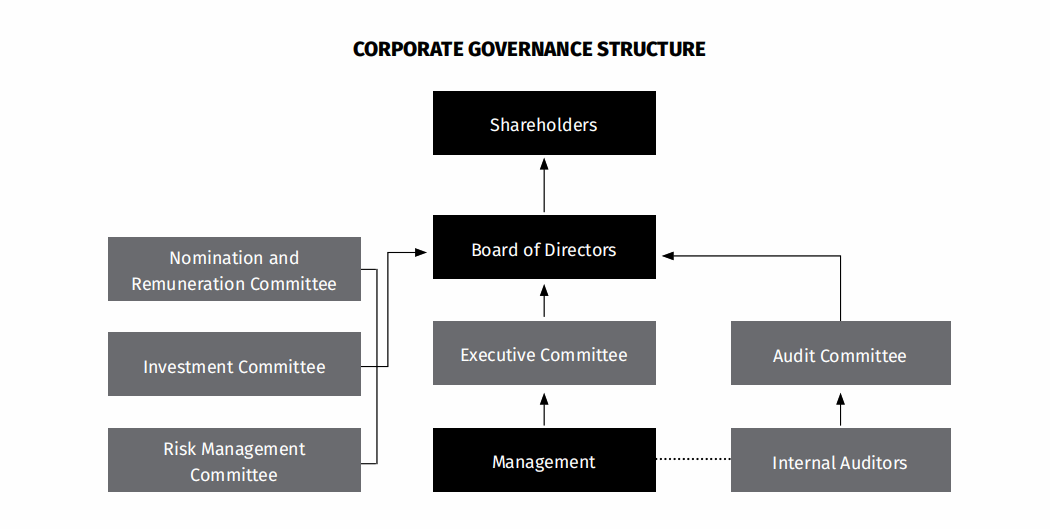

The Board is supported by the following Board Committees whose compositions are in accordance with the best

practices as prescribed by the Code to ensure the Board’s effectiveness and to efficiently discharge its duties

and responsibilities. Each Board Committee operates within its terms, which clearly define its functions and

responsibilities. Minutes of Board Committee meetings are circulated at the Board Meetings.

|

A. Audit Committee ("AC")

|

The objective, composition, terms of reference and activities of the AC together with its report are presented

on pages 62 to 66 of the Annual Report

|

B. Nomination and Remuneration Committee

|

The Company has a combined the Nomination Committee and the Remuneration Committee for the

purpose of expediency, since the same members are entrusted with the functions of both the Committees.

The members of the NRC are mindful of their dual roles, which are clearly reflected and demarcated in the

Agendas of each meeting.

Objectives

• To ensure a fair and transparent process of Board appointments, in particular to assist the Board

to identify suitable candidates and make recommendations for consideration of the Board and

shareholders.

• To set the policy framework and make recommendations to the Board on all elements of the remuneration

package and performance arrangements for the CEO, Executive Director and Non-Executive Directors.

The current members of the NRC are as follows:

| Name of Directors | Designation |

|---|

| Datuk Yap Pak Leong (Chairman) | Senior Independent Non-Executive Director |

| Madam Agnes Soei-Tin Lamey | Non-Independent Non-Executive Director |

Mr Michael @ Radio bin Luban

(appointed w.e.f. 23 February 2021) | Independent Non-Executive Director |

| |

The NRC shall be appointed from amongst the Board and shall comprise exclusively non-executive directors

and a majority of whom are independent.

The detailed terms of references of the NRC is made available on the Company’s website at www.timwell.

com.my

Nomination Function

The NRC is responsible for assessing the adequacy and appropriateness of the board composition,

identifying and recommending suitable candidates for Board membership and also for assessing the

performance of the Directors on an ongoing basis. The Board will have the ultimate responsibility and final

decision on the appointment. This process shall ensure that the Board membership accurately reflects the

long-term strategic direction and needs of the Company and determine skills matrix to support strategic

direction and needs of the Company.

Management shall engage broadly to develop a pool of interested potential candidates meeting the

skills, expertise, personal qualities and diversity requirements for both the Board and the Committee

appointments.

The NRC evaluates and matches the criteria of the candidate, and will consider diversity, including gender,

where appropriate, and recommends to the Board for appointment.

Consideration will be given to those individuals possessing the identified skill, talent and experience.

The NRC will contact those persons identified to determine interest in serving the Company. This

communication will ensure that prospective Board members have clarity regarding the nominating process

as well as Director/Board profiles, roles and responsibilities, expectations of time commitments and other

information as required.

Remuneration Function

The NRC also reviews the remuneration of the Board and Senior Management from time to time with a view

to ensuring the Company offers fair compensation and is able to attract and retain talent who can add

value to the Company. The Directors’ Fees paid to the Directors are tabled at the Company’s Annual General

Meeting (“AGM”) for approval.

Summary of Activities of NRC

During the financial year under review, one (1) meeting was held and attended by all members. The main

the activities carried out by the NRC during the financial year under review were as follows:

• reviewed the terms of reference of NRC;

• reviewed and assessed the effectiveness of the Board as a whole and the contribution of each individual

Director;

• reviewed and assessed the size, composition and the required mix of skills of the Board and Board

Committees;

• reviewed and assessed the character, experienced, integrity, competence and time commitment of

each Director and the Chief Financial Officer (“CFO”);

• reviewed and recommended to the Board, the re-election and re-appointment of retiring Directors who

will be retiring at the forthcoming AGM of the Company;

• assessed and evaluated the level of independence of Independent Directors;

• reviewed and assessed the term of office and performance of the AC and each of its members;

• assisted the Board in assessing the training needs of the Directors during the year;

• reviewed and deliberated on the Directors’ Fee and Directors’ remuneration; and

• reviewed and recommended to the Board the remuneration package and bonus pay-out of the CEO.

The NRC is satisfied with the effectiveness of the Board and its Committees, including the contributions by

each of the members based on the annual assessments conducted and affirmed by each of the members

of the Board. The NRC is confident that each of the members of the Board and its Board Committees will

continue to operate and contribute effectively.

|

C. Risk Management Committee ("RMC")

|

The RMC shall assist the Board in assessing and overseeing the Group’s business risk profile. The assessments

set out the results of the Group’s business risk assessment and provide the Risk Management Plan for the

Group. Actions and strategies adopted by the Group would be developed and executed by the management

and reviewed by the AC and RMC.

The current members of the RMC are as follows:

| Name of Directors | Designation |

|---|

| Datuk Yap Pak Leong (Chairman) | Senior Independent Non-Executive Director |

| Madam Agnes Soei-Tin Lamey | Non-Independent Non-Executive Director |

Mr Michael @ Radio bin Luban

(appointed w.e.f. 23 February 2021) | Independent Non-Executive Director |

| |

Duties and Responsibilities

assess and evaluate the Group’s overall business risk management in accordance to the policy and

strategy approved by the Board;

• deliberate and make recommendations to the Board on actions and strategies to be adopted by the

Group; and

• oversee the implementation of the business risk management action plan approved by the Board.

Further details of the Risk Management Committee is set out in the Statement on Risk Management and

Internal Control of this Annual Report.

|

D. Executive Committee ("Exco")

|

The prime function of the Exco is to assist the Board in, inter alia, developing strategic direction of the

Group for Board's consideration, ensuring implementation of Board decisions and provision of directions

to management in the implementation of short- and long-term business plans including overseeing the

business affairs of the Group.

The current members of the Exco are as follows:

| Name of Directors | Designation |

|---|

| Datuk Yap Pak Leong (Chairman) | Senior Independent Non-Executive Director |

| Madam Agnes Soei-Tin Lamey | Non-Independent Non-Executive Director |

| Datuk Pau Chiong Ung | CEO |

| |

In 2020, three (3) meetings were held to discharge its duties and responsibilities.

|

E. Investment Committee

|

The Investment Committee assists the Board in evaluating the viability of all new and potential investment

or projects of the Group, which arise out of the ordinary course of business before recommending to the

Board for approval.

The current members of the Investment Committee are as follows:

| Name of Directors | Designation |

|---|

| Datuk Yap Pak Leong (Chairman) | Senior Independent Non-Executive Director |

| Dato Sri Tiong King Sing | Managing Director |

| Datuk Pau Chiong Ung | CEO |

The Board receives periodic reports from the Board Committees and is constantly updated of their

proceedings and deliberations. In cases where the Board Committees have no authority to decide on

certain matters, the Board Committees will assess and examine the issue and subsequently provide their

recommendations, which are highlighted in their respective reports for the Board’s decisions. The ultimate

responsibility for the final decision on the recommendations lies with the entire Board.

|

1.2 Board Composition

The Board consisted of five (5) members, comprising three (3) Independent Non-Executive Directors, one (1)

Non-Independent Non-Executive Director and one (1) Managing Director.

The present composition of the Board is in compliance with Paragraph 15.02 of the MMLR and the Code as

more than half of its members are Independent Directors. The Board members have diverse backgrounds and

experiences in various fields. Collectively, they bring a broad range of skills, experience and knowledge to direct

and manage the Group’s businesses.

The Board is satisfied that, through the annual performance appraisal of the Board, the Board Committees

and individual directors, the current board composition represents a mix of knowledge, skills and experience

required to discharge the Board’s duties and responsibilities effectively.

A brief profile of each Director is presented on pages 13 to 15 of this Annual Report.

1.3 Board Balance and Independence

The composition of the Board is fundamental to its success in providing strong and effective leadership. The

Board comprises a strong mix of experienced individuals with the majority being Independent Non-Executive

Directors who offer external perspectives on the business and constructively challenge to the Executive

Director(s), particularly in developing the Group’s business strategies.

The presence of a majority of Independent Non-Executive Directors provides effective check and balance in the

functioning of the Board to safeguard the interests of shareholders and all other stakeholders.

Independence is important for ensuring objectivity and fairness in board’s decision making. All Independent

Directors comply with the criteria of ‘independent directors’ as prescribed in MMLR.

The Board, through the NRC, assesses the independence of Independent Directors annually. The criteria for

assessing the independence of an Independent Director include the relationship between the Independent

Director and the Company and its involvement in any significant transaction with the Company.

The Board is satisfied with the level of independence demonstrated by the Independent Directors and their

ability to act in the best interest of the Company and/or the Group as all of the Independent Directors have

satisfactorily demonstrated that they are independent from Management and free from any business or

other relationship with the Group that could materially affect or interfere with the exercise of objective and

independent judgement to act in the best interest of the Group.

1.4 Tenure of Independent Directors

The Company had adopted the recommendation of the Code that the tenure of an Independent Director should

not exceed a cumulative term of nine (9) years. Upon completion of the nine (9) years, an Independent Director

may continue to serve the Board subject to the Director’s redesignation as a Non-Independent Non-Executive

Director. The Board will seek shareholders’ approval in the event that a Director, who has served in that capacity

for more than nine (9) years, retains as an Independent Director. For a Director retained as an Independent

Director after the twelfth (12) years, the Board shall seek shareholders’ approval annually through a two-tier

voting process as provided under the Code.

The Company does not have tenure limits for Independent Directors and the Board is of the opinion that

the ability of an Independent Director to exercise his/her independence and objective judgment in Board

deliberations shall not be a function of his/ her length of service as an Independent Director.

The NRC had reviewed and recommended to the Board for Datuk Yap Pak Leong, who has served the Company

for the tenure of more than twelfth (12) years to continue to serve as an Independent Director of the Company,

subject to annual shareholders’ approval through a two-tier voting process as stipulated in the Code.

1.5 Board Diversity and Senior Management Team

The Board acknowledges the importance of diverse Board and Senior Management. The Group strictly adhered

to the practice of non-discrimination of any form, whether based on race, age, religion and gender throughout

the organisation, which including the selection of Board members. The Board encourages a dynamic and diverse

composition by nurturing suitable and potential candidates equipped with competency, skills, experience,

character, time commitment, integrity and other qualities in meeting the future needs of the Company.

1.6 Board Gender Diversity

The Board acknowledges the importance of boardroom diversity and the recommendation of the Code pertaining

to the establishment of a gender diversity policy.

The Board encourages and supports more women participation in the Company’s decision-making positions

whilst it continues to strive towards 30% women participation in the Board Composition. Currently out of the

five (5) Directors, one (1) is woman.

1.7 Board Appointment Process

The Company has in place formal and transparent procedures for the appointment of new Directors and Senior

Management i.e. Board Diversity Policy. The Company strictly adhered to the practice of non-discrimination

of any form, whether based on race, age, religion and gender throughout the organisation, which includes the

selection of Board members. The Board encourages a dynamic and diverse composition by nurturing suitable

and potential candidates equipped with competency, skills, experience, character, time commitment, integrity

and other qualities in meeting the future needs of the Company.

As for the appointment of Independent Non-Executive Directors, the NRC evaluates the ability to discharge such

responsibilities before making recommendation to the Board.

The Board has entrusted the NRC with the responsibility to review candidates for the Board and key Management

positions and to determine remuneration packages for these appointments. The NRC is also entrusted to the

nomination, selection, remuneration and succession policies for the Group.

On 22 February 2021, the NRC had reviewed and assessed the suitability of the appointment of Mr Michael @

Radio bin Luban as an Independent Director of the Company in line with the objective as set out in the Board

Charter in term of experience skills, knowledge, age and gender diversity and succession planning.

1.8 Re-Election of Directors

Any Director appointed during the year is required under the Company’s Constitution to retire and seek re-election by the shareholders at the following AGM immediately after their appointment. The Constitution also

require that one-third (1/3) of the Directors including the Managing Director retire by rotation and seek re-election at each AGM and that each Director shall submit himself/herself for re-election at least once in every

three (3) years.

This provides an opportunity for shareholders to renew their mandates. The election of each Director is voted

on separately. To assist shareholders to renew their decision, sufficient information such as personal profile,

meetings attendance and the shareholdings of each Director standing for election are available in the Annual

Report.

At the forthcoming AGM, the Directors retiring by rotation pursuant to Clause 97 of the Company’s Constitution

and Para 7.26 of the Main Market Listing Requirements and who have offered themselves for re-election are

Datuk Yap Pak Leong and Madam Agnes Soei-Tin Lamey.

Mr Michael @ Radio bin Luban was appointed to the Board on 23 February 2021 and shall retire and be eligible

for re-election under Clause 104 at the forthcoming AGM.

The profiles of the above-named Directors who are standing for re-election are set out in pages 13 to 15 of this

Annual Report.

|

2.0 Overall Board Effectiveness

|

2.1 Annual Evaluation

On annual basis, the relevant assessment and review forms / questionnaires in relation to the board evaluation

will be circulated to all the Directors to complete in advance of the meeting of the NRC in order to collate the

assessment results for the NRC’s review.

The Board, through the NRC, had established criteria to ensure board composition and diversity with right

mix of knowledge, skills and competency for which performance evaluation are to be based upon. The criteria

adopted for the board’s performance evaluation includes board mix and composition, directors’ training,

independence, quality of information, board proceedings, board’s roles and responsibilities and the Chairman’s

roles and responsibilities. Annual board review was conducted by the NRC to assess and evaluate the board’s

effectiveness base on the above criteria during the financial year.

In addition, peer review of the knowledge and skill sets of fellow directors is required to be performed by

each director based on evaluation criteria established, which includes integrity, professionalism, knowledge,

performance and participation during board meetings, contribution and board relationship. Peer review of

directors was conducted by the NRC during the financial year.

As for the performance evaluation of board committees, the Board assesses the performance of the AC and

NRC based on the recommended evaluation criteria adopts from Corporate Governance Guide issued by Bursa

Securities, which includes committees’ composition, contribution to the board’s decision making, expertise,

appointment as well as timeliness and quality of communication and minutes. The NRC has concluded review

of the performance of the board committees.

Based on the above assessments, the NRC was satisfied with the existing Board composition and was of

the view that all Directors and Board Committees of the Company had discharged their responsibilities in a

commendable manner and had performed competently and effectively. The Board is of the view that its present

size and composition is optimal based on the Group’s operations and that it reflects a fair mix of financial,

technical and business experiences that are important to the stewardship of the Group.

The NRC also undertakes yearly evaluation of the performance of the CFO, whose remuneration is directly

linked to performance, based on the score sheet. For this purpose, the performance evaluation for the year

2020 of the CFO was reviewed by the NRC on 22 February 2021.

2.2 Directors' Training

The Board fully supports the need for its members to continuously enhance their skills and knowledge to keep

abreast with the developments in the economy, industry, technology and updates on regulations, amongst

others to effectively carry out their duties and responsibilities as directors and to comply with continuous

training as required by the MMLR.

Most of the Directors have completed the Mandatory Accreditation Programme as prescribed by Bursa Securities,

save as the newly appointed Director, Mr Michael @ Radio bin Luban and he has registered to the MAP training

on 31 May 2021 to 2 June 2021. There were also briefings by the External Auditors and the Internal Auditors and

the Company Secretary on the relevant updates on statutory and regulatory requirements from time to time

during the Board meetings.

During the financial year, the Directors had attended training courses, conferences and seminars conducted

by various external professionals to enhance their knowledge and expertise, and the Board will continue to

evaluate and determine the training needs of its Directors on an ongoing basis.

The training course, conferences and seminar attended by the Directors during the financial year were as

follows:

| No | Continuing Education Programme Attended | Month Attended |

|---|

| 1 | Dato Seri Abdul Azim bin Zabidi (resigned on 22 February 2021) | |

| • Bank Rakyat Integrity Forum 2020 – Institutionalisation of Reforms in

the New Malaysia | January 2020 |

| • Roundtable on Rukunegara | September 2020 |

| • Managing your Fraud Risk: Are We Doing Enough? | December 2020 |

| 2 | Dato Sri Tiong King Sing | |

| • Mesyuarat Jawatankuasa Pembangunan Bahagian (DDC) Bintulu, Sarawak. | September 2020 |

| • Mesyuarat Penyelarasan Tuntutan Pembayaran Lebihan Pampasan bagi

Tanaman Kelapa Sawit untuk “Infrastructure works at Samalaju Industrial

park, Bintulu division Sarawak" | October 2020 |

| • Jabatan Komunikasi dan Multimedia mengenai Pelan Jalinan Digital Negara

(JENDELA) bagi mempertingkat Liputan dan Kualiti Jalur Lebar Negara. | November 2020 |

| • Kementerian Kewangan mengenai isu-isu semasa berkaitan Kumpulan Wang

Simpanan Pekerja (KWSP) | November 2020 |

| 3 | Datuk Yap Pak Leong | |

| • MIA Valuation for Financial Reporting Purposes

| March 2020 |

| • Modified Auditor’s Report

| November 2020 |

| • MIA “2021 Budget Seminar” | December 2020 |

| 4 | Madam Agnes Soei-Tin Lamey | |

| • MIA “2021 Budget Seminar” | December 2020 |

| 5 | Mr Loo Choo Hong | |

| • KE Consultancy Training-Workshop on Interest and Latest Tax Implications

| January 2020 |

| • KE Consultancy Training-Workshop on Net Worth Method of Proving Income | January 2020 |

| • Smart Focus-Directors Corporate Liability on MACC Section 17A | August 2020 |

| • Chartered Tax Institute of Malaysia-2021 Budget Seminar | November 2020 |

| 6 | Mr Melton Martin (resigned on 23 February 2021) | |

| • MIA “2021 Budget Seminar” | December 2020 |

| 7 | Ms Yap Fook Fung (Alternate Director to Datuk Yap Pak Leong) | |

| • MIA “2021 Budget Seminar” | December 2020 |

| | |

The Company will continue to identify suitable training for the Directors to equip and update themselves with

the necessary knowledge in discharging their duties and responsibilities as Directors.

The Directors are encouraged to attend briefing, conferences, forums, trade fairs (locally and internationally),

seminars and training to keep abreast with the latest developments in the industry and to enhance their skills

and knowledge.

|

PART III – REMUNERATION

The NRC is responsible for developing the remuneration policy and determining the remuneration packages of the

Directors so as to ensure that it attracts and retains the suitable directors to lead, control and manage the Group

effectively. In the case of the CEO, the component parts of the remuneration are structured so as to link rewards to

corporate and individual performance. For Non-Executive Directors, the level of remuneration is reflective of their

experience and level of responsibilities.

Directors’ fee and/or their remuneration are/is recommended by the Board for the approval by shareholders of the

Company at the AGM.

Other than the CEO, all Directors are paid a fixed fee and receive meeting allowance for each Board Meeting they

attended. The Chairman is paid at higher fee as compared to other Board members in recognition of his additional

responsibilities.

The details of the remuneration of the Directors of the Group and Company, paid and payable for the financial year

ended 31 December 2020 are as follows:

| | Fees and Allowances

RM’000 |

|---|

| Executive Directors | 45.0 |

| Non-Executive Directors | 275.0 |

| TOTAL | 320.0 |

| | Director Fees

RM'000 | Meeting Allowances

RM’000 | Total

RM’000 |

|---|

| Dato' Seri Abdul Azim Bin Zabidi (1) | 45.0 | 10.0 | 55.0 |

| Dato Sri Tiong King | 40.5 | 4.5 | 45.0 |

| Datuk Yap Pak Leong | 41.5 | 11.0 | 52.5 |

| Madam Agnes Soei-Tin Lamey | 40.0 | 15.0 | 55.0 |

| Mr Loo Choo Hong | 40.0 | 15.0 | 55.0 |

| Mr Melton Martin(2) | 40.0 | 8.5 | 48.5 |

| Ms Yap Fook Fung (Alternate Director to Datuk Yap Pak Leong) | - | 7.5 | 7.5 |

| Mr Michael @ Radio bin Luban(3) | - | - | - |

| TOTAL | 247.0 | 73.0 | 320.0 |

(1) Dato’ Seri Abdul Azim bin Mohd Zabidi was the Chairman of the Board until

22 February 2021 and had resigned as Independent Non-Executive Director with effect from 22 February 2021.

(2) Mr Melton Martin had resigned as Independent Non-Executive Director with effect from 23 February 2021.

(3) Mr Michael @ Radio bin Luban was appointed as Board members of the Company with effect from 23 February 2021

The numbers of the Company’s Directors with total remuneration fall within the followings bands are as follows:-

Range of remuneration | Number of Directors

Executive |

Non-Executive |

Total |

|---|

| Above RM50,000 | - | 4 | 4 |

| Below RM50,000 | 1 | 1 | 2 |

| TOTAL | 1 | 5 | 6 |

| | | |

The number of top five (5) senior management whose remuneration (comprising salary, bonus, benefits in-kind and

other emoluments) for the financial year ended 31 December 2020 within the successive bands of RM50,000 is as follows:

| |

Position | Basic Salaries,

Bonus and Other Employee Benefit

RM’000 |

Employer Contribution (EPF)

RM’000 |

Total

RM’000 |

|---|

| Datuk Pau Chiong Ung | Chief Executive Officer | 497.0 | 55.4 | 552.4 |

| William Joseph Jomiu | FMU Manager | 106.6 | 13.3 | 119.9 |

| Lee Seng Choon | Log Pond & Plantation Manager | 99.4 | 12.5 | 111.9 |

| Lee Yoke Wah | Corporate Services Manager | 101.7 | 12.8 | 114.5 |

| Suhaili Bin Sainan | Assistant FMU Manager | 71.0 | 8.9 | 79.9 |

| TOTAL | | 875.7 | 102.9 | 978.6 |

| | | | |

The top five (5) senior management with total remuneration fall within the successive bands are as follows:-

| Remuneration Band | Number of top five (5)

senior management

|

|---|

| RM50,001 to RM100,000 | 1 |

| RM100,001 to RM200,000 | 3 |

| RM200,001 to RM300,000 | - |

| RM300,001 to RM400,000 | - |

| RM500,000 to RM600,000 | 1 |

| |

PRINCIPLE B - EFFECTIVE AUDIT AND RISK MANAGEMENT

PART I - AC

1. AC Composition and Chairman

|

The AC is relied upon by the Board to, amongst others, provide advice in the areas of financial reporting, external

audit, internal control environment and internal audit process, review of related party transactions as well as

conflict of interest situation.

The AC comprises three (3) members, and all members are Non-Executive Directors, with the majority of Independent

Directors. The AC is chaired by an Independent Non-Executive Director, who is distinct from the Chairman of the

Board and all members of the AC are financially literate. None of the members was a former key audit partner of the

Company’s external auditors.

The composition of the AC, including its roles and responsibilities as well as a summary of its activities carried out

during financial year 2020, are set out in the AC Report on pages 62 to 66 of this Annual Report.

The AC has adopted a policy that requires a former key audit partner to observe a cooling-off period of at least two

(2) years before being appointed as a member of the AC and the said policy has been incorporated in the Terms of

Reference of the AC.

|

2. Oversight and Assessment of the Suitability and Independence of External Auditors

|

The Board considered the suitability and independence of the External Auditors during the discussion of the Group

Audit Plan for the financial year ended 31 December 2020. The factors that take into account including the adequacy

of experience and resources of the firm and professional staff assigned to the audit and the level of non-audit

services to be rendered by the External Auditors to the Group for the financial year under review.

The Board is aware of the potential conflict of interest situation that may arise if the Company’s External Auditors

are engaged to provide non-audit services to the Group. The External Auditors have reviewed the non-audit services

provided to the Group during the year and that to the best of their knowledge, the non-audit services did not impair

their independence. The Company also discloses fees received by the External Auditors for non-audit work for the

financial year under review in Additional Disclosure Requirements.

On 22 February 2021, the AC had conducted an annual assessment of the timeliness, competence, audit quality and

resource capacity of Baker Tilly Monteiro Heng PLT in relation to the audit, the nature and extent of the non-audit

services rendered and the appropriateness of the level of fees.

The AC had also obtained assurance confirming that the External Auditors are independent in accordance with the

terms of all relevant professional and regulatory requirements.

|

3. Financial Reporting

|

The Board aims to present a balanced and meaningful assessment of the Group’s position and prospects, primarily

through the annual financial statements and the quarterly announcement of results.

Before the financial statements are drawn up, the Directors take the necessary steps to ensure that the Group had

used all the applicable accounting policies and supported by reasonable and prudent judgements and estimates. All

accounting standards which the Board considers to be applicable, have been followed, subject to any explanations

and material departures disclosed in the notes to the financial statements.

|

4. Financial Literacy of the AC

|

The AC comprises three (3) members, all non-executive, a majority of whom (including the Chairman of the AC) are

independent. The members of the AC of the Company comprised at least one member with the requisite accounting

qualification based on the requirements of the MMLR of Bursa Securities. All members of the AC are financial

literate. The members bring with them invaluable recent and relevant managerial and professional expertise in

accounting, auditing and related financial management domains.

|

5. Relationship with the auditors

|

The Board has established a transparent relationship with the Company’s External Auditors and Internal Auditors

via the AC who has explicit authority to communicate directly with them. The External Auditors confirmed to the AC

of their independency at each financial year and during their presentation of relevant audit Memorandum.

The External Auditors are working closely with the Internal Auditors and Tax Consultants, without compromising

their independence. Their liaison with the Internal Auditors is to achieve the main objective of avoiding duplication

of efforts to maximise audit effectiveness and efficiency. The External Auditors will continue to review all Internal

Audit reports and discuss findings with the Internal Auditors.

|

PART II – RISK MANAGEMENT AND INTERNAL CONTROL FRAMEWORK

1. Risk Management and Internal Control Framework

|

The Board has the overall responsibility to ensure that sound and effective risk management and internal control

systems are maintained, while Management is responsible for designing and implementing risk management and

internal control systems to manage risks. Sound and effective systems of risk management and internal control are

designed to identify and manage the risk of failure to achieve business objective.

The Board is responsible for the Group’s risk management and internal control systems and for reviewing their

effectiveness. The Risk Assessment Management Committee supports the Board in monitoring the Company risk

exposures, the design and operating effectiveness of the underlying risk management and the internal control

systems. Thereafter, the Risk Management Committee will report to the Board after due review of the effectiveness

of the Group’s risk management and internal control by the AC.

The risk management processes in identifying, evaluating and managing significant risks facing by the Company

are embedded into the operating and business processes. These processes are undertaken by the CEO and

Management in their course of work. Key matters covering the financial performance, operating, market, regulation

and compliance, environment and etc. are reviewed and deliberated in the Business Risk Assessment Management

Committee.

The Board has been integrating the risk issues into their decision-making process whilst maintaining the flexibility

to lead the business of the Group through the ever-changing internal and external environments.

The Company continues to maintain and review its internal control procedures to ensure the protection of its assets

and its shareholders’ investment.

Details of the main features of the Company’s risk management and internal controls framework are further

elaborated in the AC Report and the Statement on Internal Control.

|

2. Internal Audit Function

|

The Board recognises the importance of good corporate governance and is committed to maintaining a sound system

of internal controls and risk management. This includes the establishment of an appropriate control environment

and risk management framework, processes and structures, and a continuous review of the adequacy and integrity

of the said systems to safeguard shareholders’ investment and the Group’s assets.

The Statement on Risk Management and Internal Control set out on pages 56 to 61 of this Annual Report provides

an overview of the state of internal controls within the Group.

|

PRINCIPAL C: INTEGRITY IN CORPORATE REPORTING AND MEANINGFUL RELATIONSHIP WITH

STAKEHOLDERS

PART I - COMMUNICATION WITH STAKEHOLDERS

The Company recognises the importance of prompt and timely dissemination of information to shareholders and

investors in order for these stakeholders to be able to make informed investment decisions. Hence, the Company’s

website has incorporated an investor relations section which provides all relevant information on the Company and it

is accessible by the public.

The Company has put in place a Corporate Disclosure Policy with the objective to ensure communications to the public

are timely, factual, accurate, complete, broadly disseminated and where necessary, filed with regulators in accordance

with applicable laws.

The Board and Management have at all time ensure timely dissemination of information on the Company’s performance

and other matters affecting shareholders’ interests to shareholders and investors through appropriate announcement

(where necessary), quarterly announcements, relevant circulars, press releases and distribution of annual reports.

The Company has identified Datuk Yap Pak Leong as the Senior Independent Non-Executive Director to whom concerns

of shareholders and other stakeholders may be conveyed.

PART II - CONDUCT OF GENERAL MEETING

The AGM is the principal forum for shareholders’ dialogue, allows shareholders to review the Group’s performance via

the Company’s annual report and pose questions to the Board for clarification.

All the Directors shall endeavour to present in person to engage directly with, and be accountable to the shareholders

for their stewardship of the Company the AGM. During the AGM, the Board encourages shareholders’ participation in

deliberating resolutions being proposed or on the Group’s operation in general.

In line with good corporate governance practices, the notice of the AGM was issued at least 28 days before the AGM.

A summary of the key matters discussed at the AGM was published on the Company’s corporate website as soon as

practicable after the conclusion of the AGM.

KEY FOCUS AREA AND PRIOTITIES ON CORPORATE GOVERNANCE

The Board, in addition to the above matters, has reviewed and adopted an Anti-Corruption Policy as guided by the

“Guidelines on Adequate Procedures” issued by the Prime Minister’s Department to promote better governance culture

and ethical behavior within the Group and to prevent the occurrence of corrupt practices in accordance with the new

Section 17A of the Malaysian Anti-Corruption Commission Act 2018 on corporate liability for corruption which came into

force on 1 June 2020 and included corruption risks in the annual risk assessment of the Group. The Anti-Corruption

Policy is published on the Company’s website.

Looking ahead to 2021, the Company will continue working towards achieving high standard of corporate governance

and leverage on technology to broaden its channel of dissemination of information and to enhance the quality of

engagement with the shareholders.

This Corporate Governance Overview Statement was approved by the Board on 26 March 2021.

DIRECTORS' RESPONSIBILITY STATEMENT

The Directors are responsible in the preparation of the Annual Audited Financial Statements to give a true and fair view

of the state of affairs, results and cash flows of the Company and of the Group at the end of the financial year.

In preparing the financial statements, the Directors will ensure that suitable accounting policies have been applied

consistently, and that reasonable and prudent judgments and estimates have been made. All applicable approved

accounting standards and provisions of the Companies Act 2016 have been complied with.

The Directors are also responsible for ensuring that proper accounting and other records are kept which disclose with

reasonable accuracy, the financial position of the Company and of the Group and which enables them to ensure that the

financial statements comply with the relevant statutory requirements.

The Directors have general responsibilities for taking such steps as are reasonably open to them to safeguard the assets

of the Group, and to prevent and detect fraud and other irregularities.

|