Corporate Perspective

Management Discussion and Analysis

The following Management Discussion and Analysis ("MD&A") of the operating performance and financial condition of Timberwell Berhad ("the Company") should be read in conjunction with the Financial Statements for the year ended 31 December 2020 and related notes thereto.

The MD&A is a mandate to advance the measurement and reporting of organisational performance. This MD&A, in combination with the financial statements, provides the opportunity for the Company to communicate the effectiveness of the stewardship of resources and to further progress towards the stated strategic objective.

The information presented in the MD&A is presented in accordance with Malaysian Financial Reporting Standards ("MFRS") and to correspond to the amendments Main Market Listing Requirement ("MMLR") of Bursa Malaysia Securities Berhad in relation to the Disclosure and Corporate Governance requirements unless otherwise noted.

OVERVIEW

The Company has been granted a Sustainable Forest Management Licence Agreement (SFMLA 06/97) for 100 years commencing 10 September 1997 over an area of 71,293 hectares in Lingkabau Forest Reserve in Sabah. The State Government of Sabah granted permission to the Company to plant, rehabilitate and harvest forest in the principles of sustainable forest management and environmental conservation for economic, environmental purposes in the licenced concession area.

Subsequently, the Company had on 12 April 2018 entered into a Sustainable Forest Management Licence Agreement (“Supplemental”) under SFMLA06/97 for conversion of 15,438.30 hectares into Protection Forest Reserve (“Class One”) and excise 10,195.28 hectares for socio-economic purpose.

The entire concession area is zoned into Natural Forest Management (“NFM”), Industrial Tree Plantation (“ITP”), and Community Forest as indicated in the following table:

| Land use | RM |

|---|---|

| Industrial Tree Plantation | 30,125.38 |

| Natural Forest Management | 15,260.28 |

| Community Forest | 273.76 |

| Total Area | 45,659.42 |

FINANCIAL REVIEW

Since the Sabah State Government has announced on the logs export ban in May 2018. The Company has then focused in domestic market and work with the local mill to export sawn timber as a change in its business strategy. The weakening timber market due to the global COVID-19 Pandemic since year 2020 resulted in the decrease in timber demand and selling price and the Group has maintained few business strategies and strict controls on capital management, including the following:

|

▸ Limited on capital nature expenditure, reduce of non-operating expenditure spending, focusing on key

priority and revenue generation. ▸ Closer monitoring on inventory and debtor management. ▸ Cost control measures, focusing on enhancing operational efficiencies. |

The Group is mindful that the economic uncertainties and difficult market conditions are expected to prevail into the new financial year in our major operating markets. The Group will continue with aggressive cost containment measures and rollout more innovative approaches in its operations to drive greater cost efficiency and productivity. The Group generated a revenue of RM18.3 million in year 2020 which has decreased RM10 million as compared to the year 2019 (RM28.3 million). The revenue reduced marginally by 35%. The decline in revenue is mainly due to the operation disruptions from 18 March 2020 to 3 May 2020 as the Government has implemented restricted movement measures to contain the COVID-19 outbreak.

The loss after tax figure of RM0.7 million was arrived at after taking into account the fair value loss derived from Biological Assets (“BA”) amounting to RM0.4 million (2019: Gain RM2.2 million).

The Company continued to appoint Messrs. Smiths Gore Sabah to conduct a fair valuation exercise on BA in accordance to MFRS 141 for the financial year ended 31 December 2020. The methods and approaches as the basis of the valuation of the following areas in the FMU 3 are Discounted Cash Flow and Income methods.

|

▸ Biological Assets (“Planted trees”) at the ITP area. |

The summary of the valuation report dated 31 December 2020 are shown in the table below:

Net Present Value (“NPV”) | 31 December 2020

RM’000 | 31 December 2019 RM’000 |

|---|---|---|

| Biological Assets | 24,820 | 24,520 |

| Intangible Assets | 59,550 | 82,770 |

| Total | 84,370 | 107,290 |

The Fair Value Loss derived from BA are illustrated as per table below:

Particulars | NBV as at 31 December 2020 RM’000 | NPV as Valuation Report 31 December 2020 RM’000 | Fair Value Loss RM’000 |

|---|---|---|---|

| Biological Assets | 25,193 | 24,820 | (373) |

| Total | 25,193 | 24,820 | (373) |

The Fair Value Loss of RM0.3 million derived from BA was reflected in the Audited Financial Results for the financial year ended 31 December 2020.

The fair value of RM60 million derived from the valuation of IA as stated in the Valuation Report is for the purpose of impairment testing and will not be incorporated into the financial results of the Company for the financial year ended 31 December 2020.

The net assets per share of the Company as at 31 December 2020 after taking into account the fair valuation of BA were illustrated below:-

Particulars | Audited result as at 31 December 2020 before fair valuation of BA | Effect of the fair valuation | Audited result as at 31 December 2020 after the fair valuation of BA |

|---|---|---|---|

| Equity Attributable to the owners of the Company (RM“000”) | 51,899 | (373) | 51,526 |

| No. of shares (‘000) | 89,051 | 89,051 | 89,051 |

| Net Assets per share (sen) | 58.28 | (0.42) | 57.86 |

The Group has also carried out a valuation exercise on the Property, Plant and Equipment ("PPE") during the financial year ended 31 December 2020. The valuation is conducted in accordance with MFRS 116 in respect of the fair value measurement of PPE and also to ascertain the carrying value of PPE of the Group for impairment purposes.

Types of PPE | NBV as at

31 December 2020 RM’000 | NPV as Valuation Report 31 December 2020 RM’000 | Fair Value Gain / (Loss) RM’000 |

|---|---|---|---|

| Investment Properties | |||

| Leasehold Land | 4,379 | 4,408 | 29 |

| Building | 6,909 | 6,498 | (411) |

| Property, Plant and Equipments | |||

| Motor Vehicle | 439 | 440 | 1 |

| Plant and Equipment | 5,237 | 5,650 | 413 |

| Building | 603 | 657 | 54 |

| Total | 17,567 | 17,653 | 86 |

The net assets per share of the Group as at 31 December 2020 will be decreased by 0.25 sen to 57.61 sen upon incorporation of the fair value loss derived from investment properties, net of deferred tax as detailed hereunder:-

Descriptions | Audited result as at 31 December 2020 before fair valuation of investment properties | Effect of the fair valuation | Audited result as at 31 December 2020 after the fair valuation of investment properties |

|---|---|---|---|

| Equity Attributable to the owners of the Company (RM“000”) | 51,526 | (226) | 51,300 |

| No. of shares (‘000) | 89,051 | 89,051 | 89,051 |

| Net Assets per share (sen) | 57.86 | (0.25) | 57.61 |

* Revaluation deficit is net of deferred tax

OPERATION REVIEW

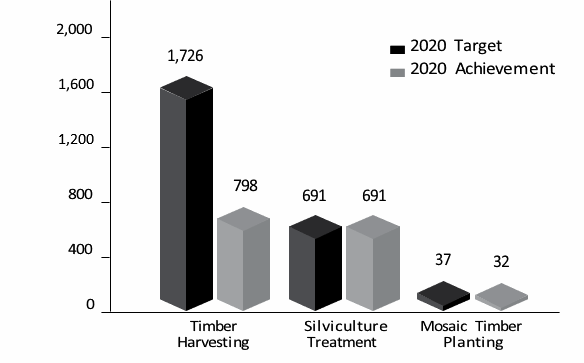

The focal operations of the Company are timber harvesting and area rehabilitation mainly involving Silviculture Treatment and Mosaic Timber Planting. The approved 2020 Annual Work Plan (“2020 AWP”) stipulates the targets for all the activities in the entire year and the achievements are assessed at the end of 31 December 2020.

The Company only managed to harvest about 46% of the targeted area for harvesting in 2020 mainly due to the restrictions during the COVID-19 pandemic.

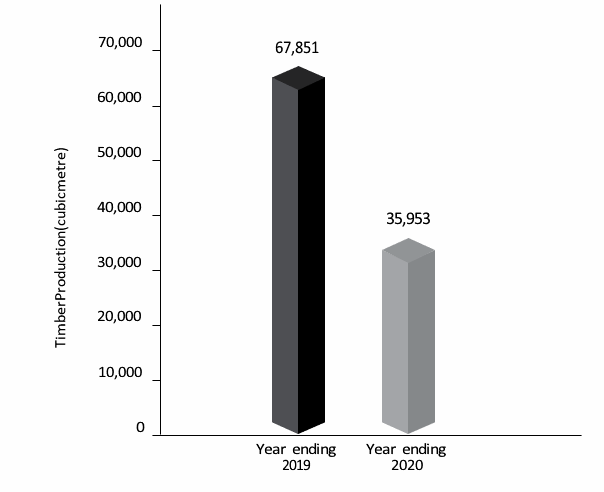

The market for timber remains challenging in 2020. The state government policy on round logs export ban remain in 2020 and the Company continue focus on domestic timber market. Despite the set-back and the impact of the pandemic especially in the first half of year 2020, the Company managed to produce substantial timber volume in the preceding half of the year.

Apart from the main tasks, other supporting activities carried out by the Company in 2020 are Area surveillance, Community Development and Outreach and Environmental inspection for Environmental Compliance. All the tasks are carried out in full compliance to the approved 2020 AWP.

Achievement & Acomplishment

For year ending 2020, the Company attained the following achievement:

The Forestry Department had on the 3 February 2020 informed that the Company has qualified to get the Compliance Certificate for the previous year achievement. However, the Certificate award was put on hold due to the restrictions enforced during the COVID-19 pandemic. Subsequently the 2020 Annual Work Plan was approved on the 26 April 2020.

Outlook & Prospect

The Management has revised the harvesting goal in 2020 to rationalise with the current health situation and market condition.

The Management is aware of the current health and economic situation and will look to improve productivity and efficiency in-line with the new-normal practiced to contain the pandemic. Within the principles of Sustainable Forest Management, the Management strives to carry out its tasks in a prudent and discreet manner while adapting to any improvement and strategy to address the evolving market, environment and social development.

WORKFORCE

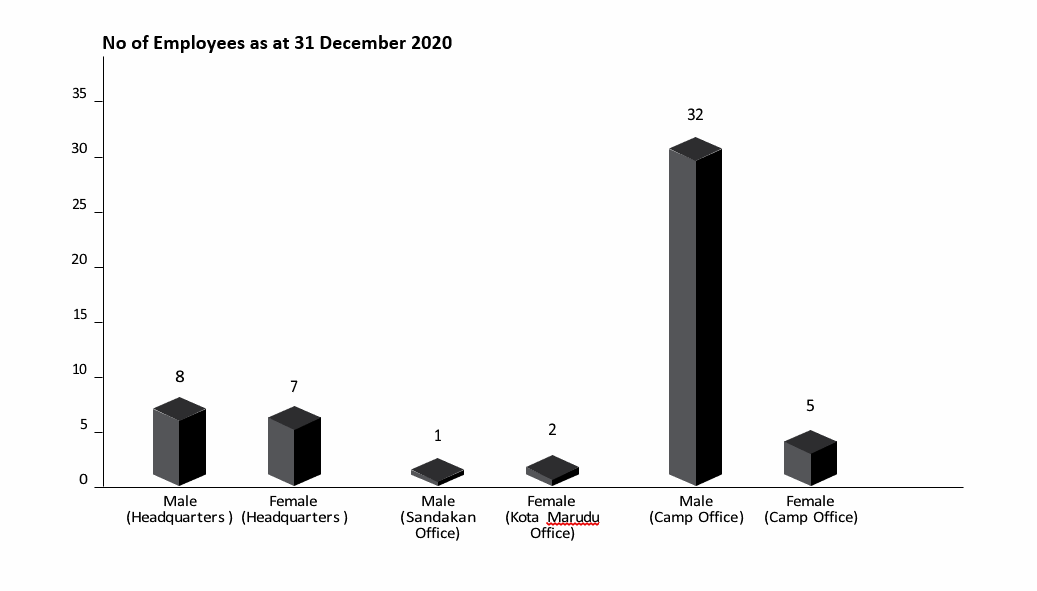

The Company is committed in creating a dynamic workplace that is able to attract, retain and develop talents as an inherent component of maintaining sustainability.

The Group itself have a diverse, multi-cultural workforce consisting of competent industry professionals. Both genders are well represented at all levels of the Group, comprising Technical and Non-Technical staffs and also the Management.

As at 31 December 2020, the workforce is equipped with 57 employees

SUCCESSION PLANNING

The Management has created a precedent for the Company’s Succession Planning to improve organisational succession and talent development programs through the Six (6) Key Elements guidelines.

|

▸ Core positions leaders are personally involved. |

The Company continued exploring the employee development plans and streamline the strategy into an “executive level” leadership development succession plan that will allow every employee to prepare and develop their future leadership roles in line with the Company’s growth.

The Company’s Succession Planning has been reviewed and assessed accordingly in the Executive Committee Meeting on 5 August 2020.

EMPLOYEE DEVELOPMENT & TRAINING

The Company believes that the people need to be developed, challenged and nurtured to be motivated in delivering the Company’s business goals. With the outbreak of COVID-19 pandemic, the Company continued emphasis in training and developing its employees despite the impediments to physical training brought about by COVID-19 pandemic.

During the year, our workforce has attended series of training and engagements pertaining to compliance awareness, finance, and environment via online platform such as zoom and webinars.

The training comprises both internal and external courses, where the records are maintained in the head office whilst the full list of training in respect to Sustainability are detailed in the Sustainability Statement

| No. | Continuing Education Programme Attended | Date |

|---|---|---|

| 1. | Sabah Forest and Timber Industry Master Plan | 17 February 2020 |

| 2. | Live Webinar COVID-19 Corporate Tax Updates (M'sia) FLPC and Baker Tilly | 17 June 2020 |

| 3. | FPLC Webinar COVID 19 Series: Paradigm Shift in Human Capital Management | 15 July 2020 |

| 4. | Workshop Forest Beyond Timber | 29 July 2020 |

| 5. | The Cooler Earth Sustainability Summit 2020 (Profits with a Purpose) | 8 September 2020 |

| 6. | The Cooler Earth Sustainability Summit 2020 (Environmental Reporting) | 10 September 2020 |

| 7. | The Cooler Earth Sustainability Summit 2020 (Building a Sustainable World) | 10 September 2020 |

| 8. | The Cooler Earth Sustainability Summit 2020 (Resilient Cities and Communities) | 15 September 2020 |

| 9. | The Cooler Earth Sustainability Summit 2020 (Managing Change for Sustainability | 24 September 2020 |

| 10. | The Cooler Earth Sustainability Summit 2020 (Tools for Environmental Risk Management) | 2 October 2020 |

| 11. | The Cooler Earth Sustainability Summit 2020 (Green Finance) | 12 October 2020 |

| 12. | The Cooler Earth Sustainability Summit 2020 (ESG Financing for Business) | 15 October 2020 |

| 13. | Technical Briefing for Company Secretaries of Listed Issuers conducted by Listing Division & Regulations, Bursa Malaysia Berhad | 9 November 2020 |

| 14. | MIA 2021 Budget Seminar | 3 December 2020 |

| 15. | MASB-MFRS Application and Implementation Committee Virtual Awareness Programme | 8 December 2020 |